Monthly Business Brief, December 2023

2 January, 2024

Economy

World Bank’s projection on Myanmar economy

According to Myanmar Economic Monitor December 2023 report, GDP is projected to grow by just 1 percent in 2023-24 budget year while the government targeted growth was 4.1 percent. Even assuming no further escalation in conflict, growth is expected to remain subdued the following year.

More than 2.6 million people fled their homes in Myanmar, UNOCHA

Since October 27th, the UN has estimated that over 660,000 people from all across Myanmar have been forced to flee their homes as a result of intense fighting in the affected regions, which includes northern and southern Shan, Kayah, and Rakhine. This brings the total number of displaced to over 2.6 million. The conflicts have reportedly inflicted civilian casualties, and the situation on the ground remains uncertain and tense.

The provision of aid by UNOCHA and other humanitarian organizations have run into several challenges. The displaced are in desperate need of food, water, fuel and shelter. However, many key roads and logistics networks have become practically inaccessible due to damages or blockades.

Real estate prices double in new satellite townships of suburban areas in Yangon

Realtors have reported that the property prices in the Dagon Myothit townships (North, East, South, Seikkan) in Yangon have doubled when compared to other similar townships. Realtors cited a combination of changing customer trends, increasing access to infrastructure, readily available transport, and the weakening Kyat as potential reasons for the rise in both real estate and rental prices. Vacant land plots alongside main roads are also highly demanded.

Reference gold price and dollar market rate

In the latest market developments, the spot gold price achieved a noteworthy milestone, reaching a peak of US$2,086 per ounce. Responding to this surge, the Yangon Region Gold Entrepreneurs Association (YGEA) adjusted its reference price to K3.28 million per tical (0.578 oz or 0.016 kg). However, the gold market is volatile, with prices reported up to K3.72 million per tical in the informal or grey market. Notably, a substantial gap of over Ks.430,000 per tical exists between the YGEA’s reference price and the prevailing rate in the unofficial market.

KYAT weakened to approximately K3,500 against the greenback at the Over-the- Counter market. The Kyat-dollar exchange rate was stable at a high of K3,500 in December in the forex market.

Banking and finance

Amount of FX reserve in CBM was US$ 8.2 billion in March 2023

The CBM reported that in March, total foreign reserves totaled US$12.13 billion, and its own reserves totaled US$ 8.2 billion. The government has frequently reassured those concerned that it has adequate foreign reserves at any given time. In 2022, it steadily increased its holdings through increased FDI and investments. Additionally, it has bolstered its reserves, despite numerous challenges, through introducing new regulations on exports and remittances, as well as expanding its currency portfolio. It has frequently used its reserves to control the exchange rate in several cases, auctioning more than US$325 million in 2021. However, CBM injections were halted in 2022. Most recently, it provided US$22.15 million to fuel importers in December 2023.

CBM deregulated on online trading in line with market exchange rates

On December 5th, the CBM announced in a directive that it would no longer be determining exchange rates on its official online forex platform, instead allowing the market to determine the rate. AD banks and others on the platform are allowed to freely conduct transactions at the market rate. When the online platform was first established in August earlier this year, the exchange rate for the US dollar was set at Ks.2900. The US dollar is currently worth around Ks.3400 in the parallel market.

CBM relaxes export earnings conversion requirement to 35%

The CBM has also further relaxed the mandatory conversion of export earnings to 35% from 50% in a notification dated December 6th. This is the second time the requirement for exporters has been relaxed, greatly easing business operations for traders. Initially in April, exporters had to convert 65% of all earnings within one working day in an MMK-denominated account; the remainder would be automatically converted if unused within 30 days. This requirement was soon reduced from 65% to 50% two months later. Conversions are still required to comply by rules and regulations set by the FESC.

CBM resets repatriation period for export earnings

On 25th December, CBM announced the period for repatriation of export earnings received from the exports to Asian countries is changed to 30 days instead of 45 days, and 60 days is changed to 90 days for depositing export earnings received from the exports to countries outside Asia.

Myanmar expatriates required to pay 2% income tax

Myanmar migrant workers and expatriates now have to pay 2% income tax on their salaries/wages in addition to being required to remit 25% of their income. Currently, the Myanmar embassies in Thailand, Japan, Singapore, Korea, and Malaysia, where there are significant Myanmar migrant populations, have announced such income tax requirements. Income tax is payable monthly, in three-month increments, or at the time of passport renewal. By paying income tax, a portion of their remittance is considered “white money” can be used to purchase homes, cars, or land in Myanmar tax free. Skilled workers (e.g. engineers, doctors, management) can deduct their income tax paid to the host government from this 2% tax. The embassies would issue a corresponding tax receipt as official documentation.

Trade

MOC announced to import essential items via bonded warehouse system

MOC announced an order on 20 December for the list of 13 essential items to be imported and stored at Custom warehouses with bonded warehouse system. These items include medical and pharmaceutical products, agriculture inputs, fuels and lubricants, packing materials, EV cars and parts, industrial raw materials and raw materials for CMP. Under the bonded warehouse system, the items will be imported without import licenses.

MOC issued 2024 vehicle import policy

MOC issued vehicle import policy on 21 December in which production years of imported vehicles are set as follows;

- Passenger/Private cars- 2023 to 2024

- Commercial (Trucks and Buses)- 2020 to 2024

- Firefighting vehicles and ambulances- 2015 to 2024

- Heavy machineries- 2015 to 2024

Left hand drive vehicles will be allowed to import for No 1 to 3 groups.

Myanmar exports reach almost US$10 billion in last eight months

Myanmar’s outbound trade for the current fiscal year 2023-24 reached nearly US$10 billion by early December, according to the Ministry of Commerce. In December alone, foreign exports totaled $254 million. The country exported a variety of agricultural products, including rice, corn, rubber, and more, along with fishery products such as fish, prawns, and crabs. Industrial products like composite material piles, fine wood, clothes, and sugar are actively being promoted for export.

Myanmar faced US$ 1.4 billion trade deficit in eight months

Despite the wide range of exports, Myanmar currently has a trade deficit of around US$ 1.4 billion this fiscal year. Although there has always been a deficit in past years, analysts observe that this year may be concerningly more than what is considered normal. The Ministry of Commerce announced that the deficit is due to increased imports from the China-Myanmar bilateral trade. Myanmar mainly imports raw materials, consumer goods, and capital goods, which include fuel.

Myanmar’s rice export volume drops by half in FY 2023-2024

As conflict intensifies near the Myanmar-China border, border trade has ground to a halt. In particular, Myanmar’s rice exports have dropped by nearly half compared to last year, according to the Ministry of Commerce. Over the past seven months, Myanmar exported 800,000 tonnes of rice worth US$240 million. Compared to the same period in the last fiscal year, export volume has dropped by nearly 450,000 tonnes, representing losses in the range of US$95 million. For the time being, rice traders have no choice but to export through sea routes, which are logistically more expensive and complicated than by land. This fiscal year, rice exports are likely to fall short of the 2.5 million tonnes amount as sought by the government. Similarly, fresh fruit and vegetables, including maize, corn, and watermelons, are likely to see a decrease in export volume as well.

Myanmar exported CMP garment to 80 countries

Over the past year, Myanmar has exported its CMP garments to 80 countries, including Japan, the UK, the US, and other European countries. The CMP sector is one of Myanmar’s most important industries, accounting for a substantial number of its exports every year. Last year, the industry accounted for US$5.3 billion in foreign exchange earnings for the country.

Investment

Myanmar China ink addendum for Kyauk Phyu Deep Seaport Project

Responsible officials from Myanmar and China signed an addendum for Kyauk Phyu Deep Seaport Project in Nay Pyi Taw on 26 December. The Kyaukphyu SEZ project is a heavy infrastructure project with a large amount of investment through Myanmar- China Cooperation. After completion of a deep seaport project in the Kyaukphyu SEZ, it will become Myanmar’s first international level deep seaport, facilitated with 10 jetties capable of seven million 20 ft containers per year. All export commodities from Myanmar and China passing through Myanmar to African, Southeast Asian and European countries. The investment share of this project will be 70% from China and 30% from Myanmar side.

MDY Intl Trade Fair & Investment Forum 2023 fostering regional entrepreneurial connections

The Mandalay International Trade Fair and Investment Forum 2023, held from December 20 to 22, opened to great success, according to reports. The event allowed stronger relations between local Mandalay entrepreneurs and businessmen from all across the Southeast Asian region. A design for the Mandalay Myotha Industrial Park was showcased for potential investors, highlighting its ease of accessibility and ideal location. Discussions on topics ranging from agriculture and livestock, hotel and tourism, and sustainability were also held. Over 240 exhibition booths were present at the event from countries including India, China, Vietnam, Bangladesh, and Myanmar.

Energy

Fuel supply problem faced in the whole country pushed car owners to line up

Fuel prices increased by 10-20%

In December, car owners experienced severe fuel shortages across Yangon that saw long queues of vehicles at many gas stations. Some vehicle owners lined up as early as dawn, hoping for a chance to secure fuel for the day, according to residents. The shortage was caused in part due to the local currency’s depreciation against the dollar in recent months, creating many difficulties for importers in their ability to pay for fuel shipments.

The Fuel Import, Storage and Distribution Supervisory Committee’s reference prices for gasoline and diesel on December 23 saw increases of over 10% and 20% respectively. Residents and commuters report that taxi fares have also increased as a consequence, although municipal bus fares have remained unchanged.

Transportation

Central section of Thanlyin Bridge 3 in Yangon completed

The Ministry of Construction reported that the central part of Thanlyin Bridge 3 has been completed, with the expected completion date of the project to be by May 2024. The project began in 2019 with funding from the Japan International Cooperation Agency (JICA) and assistance from Japanese consultants and engineers. When complete, the bridge will connect Yangon and Thanlyinn across the Bago River, and will facilitate the travel of goods from Thilawa SEZ.

COVID

In order to continuously control the infection of COVID-19, the rules and restrictions have been extended until the end of January 2024.

Monthly Business Brief, February 2023

3 April, 2023

Economy

According to National Planning Commission, GDP growth for 2022-23 was calculated by 3.4% however the National Planning Law 2023-24 is not released yet.

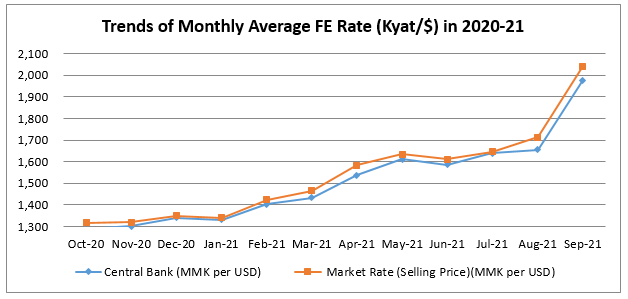

On 31 March 2023, financial institutions including banks and informal money exchanges are instructed to set a dollar value at K2,094 for buying and K2,106 for selling. However, in the market Kyat-dollar exchange rate was K2,855 for buying and K2,870 for selling meanwhile the Central Bank of Myanmar (CBM) set the reference exchange rate at K2,100. There is a large price difference between the reference rate of the CBM and the unofficial market rate for the whole year.

On the other hand, the fuel prices stood at K2,110 for Octane 92, K2,200 for Octane 95, K2,070 for diesel, and K2,150 for premium diesel on 31 March 2023. The octane exceeded diesel significantly in price. During March, there are some businesses which need diesel for power supplies since Summer season has started and there’re power cut off everywhere. However, the consumption of diesel has been restricted to a certain extent. The fuel stations limit the amount of liter they can buy and also the businesses need to show a letter to buy it.

Banking and Finance

On 20 March 2023, ATOM – CB Co-branded MPU credit cards have been introduced to the market providing better benefits for Platinum Star users of ATOM. Starting on launching day, credit cards can be easily applied through the ATOM Store App and the ATOM Website.

Next Tax law and Union Budget Law have not been released till end of March.

Trade

In the fiscal year 2022-2023, Myanmar’s total trade volume was $33.36 billion, while it was $29.33 billion in the same period last year. Total foreign trade was $4 billion more than the same period last year, according to statistics released by the Ministry of Commerce. During this period, the amount of exports to foreign countries was $16.28 billion, which was $1.39 billion more than the same period last year. Similarly, the amount of imports from foreign countries was $17.08 billion, which was $2.63 billion more than the previous year.

On 22 March 2023, the Department of Trade released a notification of seeking import licence for all types of goods including ones stored under customs warehousing before the goods arrive at the port is obligatory. Additionally, importers were notified to face legal actions in line with the Export and Import Law if early arrival of the goods without import licence or permit of the departments concerned was found. Therefore, an import licence is required for all items including goods to be stored at the Customs warehouse before arrival, intending to steer trading activities and maintain the quality of the goods due to failure to claim the goods from the Customs bonded warehouse for a long period. Thus, the statements will cease to be in effect for six months from 1 April 2023 and suspension might extend, if necessary.

According to Department of Trade, Export licences can be done through Myanmar Tradenet 2.0 portal starting from 1 April 2023. In order to facilitate the export/ import licencing process and conduct exports/imports systematically, traders are allowed to export the goods only after seeking an export licence via Myanmar Tradenet 2.0 platform. Having digitized the licencing system, licencing for certain lines that do not need to apply for export licence will be automatically passed on the system. According to 2022 Myanmar Customs, commodities lines with 10-digit HS Code are available to be apply for an export licence on Myanmar Tradenet 2.0.

According to the statistics of the Myanmar Garment Manufacturers Association, CMP garment exports generated over $4.7 billion income abroad during the first 11 months of the 2022-2023 financial year.

According to the statistics released by the Myanmar Rice Federation (MRF), the rice export by Myanmar during the last 11 months from April 2022 to February 2023 in the 2022-23 financial year was 2.09 million tons and earned $783 million.

Last but not least, Myanmar brought in over $1.2 billion from over 1.6 million tonnes of various pulses exports over the past 11 months of the current financial year 2022-2023, according to the statistics of the Ministry of Commerce.

Myanmar has been bringing in electric vehicles (EVs) under the customs tariff relaxation through seaborne and border trade routes, according to the Ministry of Commerce. On 3 March, a fleet of 30 Dongfeng EVs imported by Asia Pacific Automaker Corporation Co Ltd arrived in the Muse 105th mile trade zone in northern Shan State. Chindwin Shan Co Ltd also took out 7 kW GB AC five chargers for EVs on 21 February 2023 from the port terminal. The importation of the EV charger is exempted from Customs tariffs to enhance the EV sector in the domestic auto market. On 6 March 2023, another five sets of EV chargers for battery electric vehicles arrived at Yangon Thilawa Port. On 26 March 2023, next five sets of EV chargers arrived at Yangon International Airport.

Investment

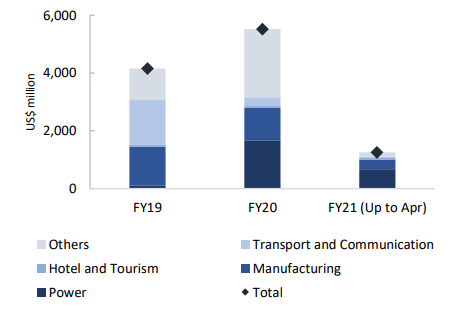

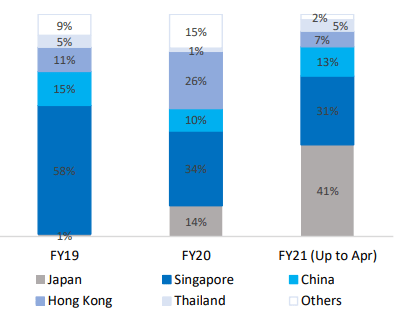

In the first 11 months of the fiscal year 2022-23 starting from April to February last year, Myanmar attracted more than 1.62 billion U.S. dollars in Foreign Direct Investment (FDI), according to figures released by the Directorate of Investment and Company Administration (DICA). Throughout the year, the Myanmar Investment Commission (MIC) approved 73 foreign investment enterprises. During the period, the power sector attracted most foreign investment with capital of over 820.27 million dollars, followed by the services sector with over 500.91 million dollars and the manufacturing sector with over 258.02 million dollars. Singapore, China and Thailand are largest investors in Myanmar.

Manufacturing

The IHS Markit Myanmar Manufacturing PMI climbed to 55.5 in March 2023 from 51.5 in February. March data signalled a robust improvement across Myanmar’s manufacturing sector. Production rose at the fastest pace on record and new orders increased at a near-record pace. Firms largely attributed the upturn to strengthening client demand and a growing client base. Moreover, supply chain pressures eased at the end of the first quarter, as average lead times increased to the smallest degree in one-and-a-half years.

Energy

The Department of Electric Power Planning under the Ministry of Electric Power signed a Memorandum of Agreement (MoA) on wind power projects to be launched in An, Gwa and Thandwe townships of Rakhine State with the Primus Advanced Technologies Limited, Asia Ecoenergy Development Limited and Yunnan Machinery and Equipment Import and Export Co Ltd on 1 March, 2023.

Tourism

The Kawthoung-Ranong border gate has been allowed to reopen as an international entry and exit point. The border crossing between Kawthoung city in southern Myanmar and Ranong city in southern Thailand has been approved on March 7, 2023. For this permission, travellers have been able to visit Thailand and Myanmar with passport and CI books.

Regional Cooperation

In honour of the 7th Anniversary of the Mekong-Lancang Cooperation on 23 March 2023, the Exhibition on the Achievements of Mekong-Lancang Cooperation Special Fund Projects in Myanmar was organized by the Ministry of Foreign Affairs followed by the commemorative reception in Nay Pyi Taw. The dignitaries observed the exhibition on the outcome of 92 MLC Special Fund projects implemented by 17ministries in 34 cooperation areas.

COVID

In order to continuously control the infection of COVID-19, announcement of the extension of the restriction of COVID’s rules and restrictions have been extended until 30 April 2023.

Monthly Business Brief, February 2023

1 March, 2023

Trade

According to the Department of Trade, truck drivers need to seek QR code-based Vehicle Pass permits beforehand on digital platforms in order to export good in border trade. The department has launched an online system starting from 11 February to issue vehicle passes to facilitate the exports of various pulses, corn, sesame and peanut in the border channel like Muse, Myawady and Chinshwehaw. The trucks can pass the checkpoints with a QR code. Each truck will be charged K5,000. Those drivers which fail to show the QR code are not entitled to leave.

Based on the data from the Ministry of Commerce, Myanmar’s trade reached over $4,500 million via Myanmar-Thai border trade posts within 10-month and half period, from 1 April 2022 to 17 February 2023 which indicates exports of goods having around $3,000 million and imports over $ 1,500 million. Myanmar carries out border trade with Thailand via Tachilaik, Myawaddy, Kawthaung, Myeik, Hti Khee and Maw Taung border trade posts. Myanmar mainly exports CMP products, agro-products and aquatic products to Thailand.

Since electric vehicles (EVs) and related sectors such as EV battery production, electric bus operation services are given priority by the government, businesses are preparing for the importations of machinery, essential equipment and accessories, spare parts, as well as launching of EV car showrooms. On 21 February 2023, the Ministry of Commerce released a directive stating the rules for the importation of battery electric vehicles (BEVs) and showrooms.

During the pilot project, the importing companies of EVs must register with the Directorate of Investment and Company Administration. They have to submit the sales contract with each EV manufacturer. The importers must abide by the standards and import quota set by the national-level steering committee on the development of electric vehicles and related business.

The companies also need to pay K50 million at the designated banks and present the bank guarantee. Those showroom operators must present a certificate of non-tax delinquency provided by the Internal Revenues Department and need to add K100 million to a special account of the authorized banks as a guarantee. Only vehicles with left-hand drive can be imported. The models for private vehicles are set to be one year older than the current year. The showroom operators can import the vehicles in line with the auto import policy issued every year.

Investment

On 12 February 2023, the Myanmar Investment Commission (MIC) approves 8 new projects including renewable energy-generating electricity. MIC greenlighted the expansion of the capital in eight ongoing investment projects and new investments in the electricity sector, the transport and communications sector, the petroleum and gas sector, the industrial sector, the hotels and tourism sector and the service sector. The investment amount of these businesses is US$ 143.634 million and K 98,078.094 million generating 1,374 domestic job opportunities. Out of 52 countries and territories investing in Myanmar, Singapore, China and Thailand ranked the largest shares of investments as of end-January 2023. Among the twelve economic sectors, the most invested sectors are 28.30 percent of the total investments in the electricity sector, 24.63 percent in the petroleum and natural gas sector and 14.34 percent in the industrial sector.

Tourism

On 20 February 2023, the No.1 Friendship Bridge of Tachilek-Mae Sai was reopened after being closed for three years due to COVID-19 control restrictions. It was reopened after officials of the two countries negotiated several times. Temporary border crossing passes are also issued at the bridge. Passers-by can use the bridge if they can show full vaccination for COVID-19.

Transportation

In 2022, the Yangon International Airport served over 2 million arriving/departing passengers and more than 33,000 flights, according to the Yangon Aerodrome Company Limited (YACL), which takes responsibilities of services at the Yangon International Airport.

Regarding International shipping, a total of 655 container ships which loaded 20,000 to 30,000 tons entered Myanmar in 2022. There were 45 container ships in January and 51 in February 2023. Kaladan Multi Transportation project will be started soon and 5,000 – 6,000 ton ships will be entered to Sittwe Port.

COVID

In order to continuously control the infection of COVID-19, announcement of the extension of the restriction of COVID’s rules and restrictions have been extended until 31 March 2023.

Monthly Business Brief, January 2023

1 February, 2023

Economy

During January 2023, the foreign exchange rate in the unauthorized market is around MMK 2,850 to 2,900 while the CBM’s reference rate is MMK 2,100, showing a large price difference of K700 compared to the unauthorized market rate.

The domestic fuel price is still high throughout January. On 20 January 2023, the prices of fuel oil were K2,200 per litre for Octane 92, K2,275 for Octane 95, K2,420 for diesel and K2,500 for premium diesel. Then on 28 January, the prices of fuel oil were MMK 2,275 per litre for Octane 92, MMK 2,355 for Octane 95, MMK 2,490 for diesel and K2,570 for premium diesel. The figures indicated an increase of MMK 70-80 per litre depending on the types of oil within one week. The rates for regions and states are way higher than Yangon since the costs are evaluated after adding the transportation cost.

Low and high grades of paddy fetch skyrocketing prices in January 2023. Low grade paddy like Thukha, Hnankar were traded with about MMK 1.5 million and high grade like Pawsan fetch MMK 1.7 to 2.2 million per 100 baskets (52 lbs).

Although production is lower than 2019 due to crises and electricity shortage problems, the world bank predicted Myanmar will achieve 3% growth in 2023.

Banking and Finance

Insurance market

The insurance market in Myanmar is profitable and growing but still at the nascent stage. More and more products are being introduced every year. People are becoming aware of the availability of insurance products as the agents get trained and push for sales. On the other hand, the insurance companies still need to build a good rapport and trust with the customers.

The most common one is the car insurance. Even though the payout ratio is 25 per cent on average across the industry, the car insurance payout is the odd one out with more than 50 per cent payout. Every car in Myanmar needs to have third-party liability insurance provided by Myanmar Insurance, at the time of vehicle license renewal. The cost is only around $10-$15 and the payout is only around $1,500 in the event of the death of a third party.

However, there is the downside of insurance market in here. That’s people are experiencing more insurance frauds at the same time. It is time the insurance industry starts keeping a record of insurance fraudsters so that honest policyholders do not have to subsidize the criminal actions of these few people. All entities and individuals are encouraged to buy coverage from licensed insurers within the country. The growth of the insurance market is taking much longer than expected so far.

At the current moment, more agents are being trained in both life and general insurances. The agents work under one-year contract committing themselves to the insurer. The companies acting as agencies with teams of agents are likely to appear in the foreseeable future. People are also considering the issue of inflation and insuring in a soft currency.

Trade

On 14 January 2023, trade activity at the Muse-Mang Wein on some Sino-Myanmar border, which have been closed down for three years, reopened. They will be accessible by road vehicles (trucks, vans, motorcycles) again. Additionally, the driver-substitution system will be abolished along with the reopening of the border crossings. However, only six-wheel trucks driven by Myanmar drivers are allowed to pass the Mang Wein crossing. Other trucks are still not given the green light. Passengers are not entitled to pass it as well. General cargo is allowed through Mang Wein gate to trade except agri, livestock, fruits and mineral products which can be traded through Jinsan Jao gate.

Investment

On 25 January 2023, the Yangon Region Investment Committee (YRIC) endorsed nine foreign enterprises and one domestic business in the power and manufacturing sectors, creating 4,300 jobs for residents. They will execute solar power projects, milling and production of sunflower oil and peanut oil, refining and production of palm oil, printing and dyeing enterprises, manufacturing of electrical appliances and production of footwear on a Cutting, Making, and Packing (CMP) basis.

Tourism

In Myanmar-Thai border, on 12 January 2023, operations were resumed at the Myawady-Mae Sot Friendship Bridge I after nearly three years of closure. Therefore, people can enter the Mae Sot side by passing that bridge with the border pass as before. For a border pass document, Myawady residents can apply for it by presenting a citizenship scrutiny card, household registration and three pictures of the licence-sized photo. Licenced private cars are entitled to go over the bridge and the passengers need to present COVID-19 vaccination certificates.

Tachilek-Mae Sai Friendship Bride I will be reopened soon, which was also closed for nearly three years due to the COVID-19 pandemic.

In Myanmar-China border gates in Nantaw and Sinphyu of Sino-Myanmar borders reopened on 25 January 2023, which have been closed down for three years.

Transportation

According to the Rakhine State Chambers of Commerce and Industry, the new Sittway Port, a transit transport project of Myanmar and India, will be opened soon. The new port is a multi-modal transit transport facility on the Kaladan River connecting Myanmar and India. Currently, the port is ready for the entry and exit of international ships and plans are underway to admit the local vessels.

On 21 January 2023, Mandalay-Mangshi direct flight has been resumed which operates three days a week. Ruili Airlines had temporarily suspended flights due to the Covid-19 pandemic but has launched weekly flights on Tuesdays, Thursdays and Saturdays starting from 21 January.

COVID

In order to continuously control the infection of COVID-19, announcement of the extension of the restriction of COVID’s rules and restrictions have been extended until 28 February 2023.

Monthly Business Brief, December 2022

4 January, 2023

Economy

Myanmar’s economy has faced a series of external and internal disruptions which have impeded recovery from the large contraction in economic activity starting from 2021. The GDP growth target for 2022-23 budget year by Ministry of Planning and Finance (MOPF) is 3.7%. Based on the released data, achievement of first six months (Apr-Sep) was 3.4%.

Myanmar economy is currently facing a range of constraints which include a sharp rise in the prices of imported inputs and consumer goods with the increasing currency exchange rate, electricity outages, and other matters.

At the end of December 2022, Gold market price was still rocketed to K 2.69 million per tickal and FE market price was K 2,850 per US$. Fuel oil market prices in yearend stood as below;

- K 2,010 per litre for Octane 92

- K 2,080 per litre for Octane 95

- K 2,365 per litre for Diesel

- K 2,445 per litre for Premium Diesel

Banking and Finance

According to the released statement from CB Bank, all MPU Debit card holders of CB Bank can withdraw cash from its ATM. Starting from 1 December 2022, the MPU debit card holders can withdraw K300,000 per day from an ATM and the withdrawal limit per week from the ATM is K500,000.

The government provided K30 per dollar (an equivalent amount of foreign currency) in the salary remitted by Myanmar citizens abroad. The authorized CB Bank adds another K10 to this government’s contribution of K30. When their family members withdraw cash, they will get an additional contribution of K40 per dollar that becomes K2,500 which is closer to market rate of K2,850. Those additional contributions cover the foreign income by Myanmar citizens including seamen and Myanmar migrant workers. Only the remittance of foreign salary through the authorized banks is entitled to this. In addition to the additional contributions and commission, they are exempted from tax on foreign income inward remittance under the Union Tax Law.

Yangon Stock Exchange

Due to the indication of the Yangon stock Exchange’s monthly price data, the stock trading values by seven listed companies on the YSX were estimated at over K558 million with 103,292 shares traded in November 2022.

Shares can be traded using the call auction system or the block trading system. For those who would like to trade in the Yangon Stock Exchange’s share market, they should learn the Trading Business Regulations issued by the Yangon Stock Exchange.

YSX launched a pre-listing board (PLB) on 28 September 2020 to provide unlisted public companies with fund-raising opportunities and build a bridge toward listing on YSX. Moreover, the YSX stock investment virtual series 2022 launched in December through the YSX YouTube channel and other social media platforms every weekend of December 2022.

Trade

According to the statistics released by the Ministry of Commerce, the value of border trade via the Myawady border post between 1 April and 25 November hit US$1.456 billion. The figures showed a drastic drop of $148.545 million recorded in the corresponding period last year. The trade policy changes and political instability in the border areas resulted in an extreme fall in export to Thailand. The border trade between Myanmar and Thailand through Myawady, Tachilek, Kawthoung, Myeik, Hteekhee, Mawtaung and Meisei amounted to $3.452 billion, which is an increase of $451.342 million from the year-ago period.

Referring to the Ministry of Commerce’s statistics, Myanmar earned US$82.33 million from rice and broken rice exports in November 2022. Myanmar’s seaborne rice exports to international trade partners amounted to $47.64 million from over 122,150 tonnes in November 2022, with over 105,750 tonnes to Asian countries and over 16,390 tonnes to European Union member countries.

In addition, maritime trade operations are served by 46 international jetties at the current moment.

The Ministry of Economy and Commerce announced that the vehicle import policy for 2023 will continue to be applied without any changes.

Investment

The Yangon Region Investment Committee (YRIC) endorsed one domestic project and one foreign enterprise in the manufacturing sector, with an estimated capital of over K4.08 billion and US$0.50 million during December 2022.

A total of 41 foreign enterprises pumped US$187.426 million into Myanmar’s manufacturing sector in the past eight months (April-November) of the current financial year 2022-2023, including capital expansion by the existing enterprises, as per the statistics released by the Directorate of Investment and Company Administration (DICA).

COVID

In order to continuously control the infection of COVID-19, the rules and restrictions have been extended until the end of January 2023.

Monthly Business Brief, November 2022

1 December, 2022

Banking and Finance

The US dollar exchange rate in Market seemed to be stable during November, compared to the previous months. Last August, a dollar hit over MMK 4,000 in the black market. At present, the dollar was exchanged at MMK 2,860 for buying and MMK 2,880 for selling while the Central Bank of Myanmar (CBM) set the reference exchange rate at K2,100.

On 18 November 2022, the CBM announced that export earnings can be made in Chinese Yuan and Thai Baht in addition to the US dollar. In order to make Yuan and Baht payments, the traders need to apply for a license. As per the US dollar policy, 65 per cent of earnings must be exchanged for local currency at the CBM’s reference foreign exchange rate, while exporters can use 35 per cent of export earnings or sell them on to others with an over-the-counter rate within one month.

Trade

Starting from 1 November, imports are to be allowed based on the export earnings or flows of funds and the initial stage of this move will commence in Myanmar-Thailand border areas, according to 31 October 2022 of the Trade Department under the Ministry of Commerce. To improve Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) measures and follow the Action Plan of the Financial Action Task Force (FATF), banking will be utilized in settling border transactions. Imports will be allowed only with the banking system in border transport.

On 11 November 2022, the Ministry of Commerce released the announcement upon the import rules for electric vehicles (EV) in the pilot project. Here are some of the rules the importers have to follow:

- The importers must abide by the standards and import quota set by the national-level leading committee on development of electric vehicles and related business.

- The companies must register with the Directorate of Investment and Company Administration whether it is a joint venture or wholly citizen-owned business.

- They must show the sales contracts with exporting companies. They have to be sought approval from a national-level leading committee on the development of electric vehicles and related business. There must be an EV warranty, spare parts availability, and service and maintenance of those vehicles.

- The companies must seek permission from the MoC to register with the Road Transport Administration Department.

- The rules in the directive are effective between 1 January 2023 and 31 December 2023. Further amendments are to be made if necessary.

Investment

In the past seven months (April-October) of the current financial year 2022-2023, a total of 35 foreign enterprises pumped US$179 million into Myanmar’s manufacturing sector including capital expansion by the existing enterprises, as per the statistics released by the Directorate of Investment and Company Administration (DICA).Myanmar attracted foreign direct investments of $1.45 billion from 52 enterprises during April-October period 0f 2022. The majority of the investments brought into the manufacturing sector.

In addition, according to the Directorate of Investment and Company Administration (DICA), a total of 4,100 companies have been struck off the register in the past ten months as they fail to submit annual returns (AR) on the online registry system, MyCO. In 2022, 400 companies each in January, February and March, 300 in April and 500 in May, 400 each in June and July, 55 in August and 400 each in September and October did not file annual returns on MyCO respectively.

COVID

In order to continuously control the infection of COVID-19, the rules and restrictions have been extended until the end of December 2022.

The government issued an announcement on the control of COVID-19 to take tests with RDT will be relaxed for travelers to Myanmar by international commercial flights if they show COVID-19 vaccination record cards as a proof of being fully vaccinated or if the travelers who are not fully vaccinated show the RT-PCR test results within 48 hours before their arrival to Myanmar on 1-12-22. The details will be published in Public Health Requirements for travellers who wish to enter Myanmar through International Commercial flights on 1-12-22. However, the public health requirements for travelers by relief flights and travelers via land borders will remain the same as previous requirements on COVID restrictions.

Logistic Market of Myanmar, 2022

14 November, 2022

Logistic market before COVID

Logistic is understood as a network of services that support the physical movement of goods, trade across borders, and commerce within borders. It comprises an array of activities beyond transportation, including warehousing, brokerage, express delivery, terminal operations, and related data and information management. For every country, logistics performance is the key to economic growth and competitiveness. Inefficient logistic raises the cost of doing business and reduces the potential for both international and domestic integration, especially for the developing countries like Myanmar.

Myanmar Freight and Logistics Market is segmented by Function (e.g., freight transport, freight forwarding, warehousing, and value-added services and others), End User (such as manufacturing and automotive, oil and gas, construction, distributive trade, etc.), and Other End Users (like telecommunications, food and beverage, pharmaceutical, and so on). According to Mordor Intelligence’s report, Myanmar freight and logistics market is anticipated to record a CAGR of more than 7% during the forecast period which is from 2018 to 2027. The market was valued at USD 4.32 billion in 2020. The logistics sector in the country is under transformation, driven by increasing trade activity, improving connectivity, and the entry of major international players.

Logistic market in Post COVID

Logistic services in Myanmar have been substantially hit by COVID-19 since 2020 and political instability in 2021. Logistics companies have been affected by rising fuel prices, border closures, and a shortage of shipping containers. Higher fuel prices and currency liquidity shortages significantly increased the cost of inland transport services. Transportation and logistics services are expected to be severely impacted by continuing high fuel prices, mobility constrains, political instability, and evolution of the pandemic. The export and import via container are expected to recover gradually due to agricultural and garment industry-led demand.

By referring the report from Market Watch in August 2022, Myanmar freight and logistics market is expected to reach a market value of USD 7.52 billion by 2023. Currently, almost all international trade that is occurring in Myanmar via the sea route is being handled by the port area of Yangon (almost 90%). Hence, international inland water freight forwarding is heavily focused at the Yangon port area, with the ability to handle containers. The key area of focus to give the preference for cross-border land trade, instead of sea or air is that cross-border road transport is preferred more by Myanmar business owners when dealing with countries, such as China and Thailand.

New logistic routes in 2022

Other than normal sea trade in Yangon Port, a new sea transport is being started by shipping 2,605 ton of Myanmar rice export to Bangladesh from Ayeyawady International Industrial Port in Pathein Inddustrial City of Ayeyawady Region. In land route, China-Myanmar new transport mode is kicking off with one bill of landing for 1,220 kilometers through 20 checkpoints from Chin Shwe Haw to China market. Myanmar export goods are loaded to Chin Shwe Haw border with road access and those goods are to be delivered to bonded zone area through a rail link at Lanchang. The Ministry of Construction announced a feasibility study will be conducted on the Maei-Kyaukpyu road section as part of the Nay Pyi Taw-Aunglan-Maei-Kyaukpyu road project. The project is one of the Early Harvest Projects of the China-Myanmar Economic Corridor. Maei-Kyaukpyu section is the project aiming for the number of vehicles used in the Kyaukpyu Special Economic Zone and Deep Seaport Project.

Future of Logistic services

However, the road network in Myanmar is weak and underdeveloped compared to ASEAN nations, with more than half of the road network being unpaved. The improper infrastructure coupled with the lowest motor vehicle penetration in Southeast Asia results in high transportation costs and long travel times. This makes the trucking costs in the country comparatively higher than in other countries in ASEAN. As part of Myanmar’s Sustainable Development Policy 2018-30, transport infrastructure development is a prioritized area.

In order to increase freight transport efficiency and maximize investments, a logistics corridor development strategy is being considered. Under this strategy, investments will be concentrated within six so-called logistics corridors, including major transport and cargo systems, such as roads and rivers linking large industrial clusters to border gates and ports.

According to the Director of World Bank Group, good logistics reduce trade costs, but supply chains are only as strong as their weakest link. Getting logistics right means improving the infrastructure, custom procedures, skills and regulations for the developing countries like Myanmar.

Monthly Business Brief, October 2022

1 November, 2022

Banking and Finance

- At the beginning of October, seven private banks opened special counters to facilitate gold transactions with the banking payment system.

- On 21 October 2022, social media released that the Financial Action Task Force (FATF) has placed Myanmar on its “Blacklist” that the country does not comply with international anti-money laundering standards. The consequences of the announcement led to a rocket increase in unacceptable dollar exchange rate in the market which was over MMK 5,000 per dollar due to panic buying and speculation.

- However, CBM issued a statement on 22 October 2022 urging the people not to worry about the announcement of Financial Action Task Force-FATF in which FATF put the country to the list of High-Risk Jurisdictions Subject to a Call for Action under increased monitoring. It is not under blacklist. Myanmar has complied 24 points FATF’s recommendations out 40 standard points and Myanmar has been implementing Action Plan to fulfill the standard requirement. CBM gave warning that any currency market manipulator or those who do not comply with the rules and regulations shall face action.

- After the CBM announcement, the dollar exchange rate goes down a bit to around MMK 3,000 per dollar.

Trade

- On 19th October 2022, eighteen types of imported pharmaceuticals are granted Customs tariff exemption, according to the Myanmar Automated Cargo Clearance System (MACCS) Division under the Customs Department.

- They are Aspirin, Paracetamol, Chlorpheniramine maleate, Diazepam, Mebendazole, Gentamicin, Metronidazole, Propranolol, Oral Rehydration Salt, Chlorpromazine, Salbutamol, Intravenous Glucose, Rifampicin, Ethambutol, Isoniazid, Frusemide, Digoxin and Prednisolone.

- Additionally, 21 types of medicines will be imposed five per cent of customs duty and 1.5 per cent of duty will be paid for the remaining, presenting HS code along with obelisk code 4 in the customs declaration form.

- Starting from 1st November 2022, the Department of Trade will issue Certificate of Origin (CO) Form RCEP to the products that originated in Myanmar and are designated to be exported to China so that the authorized traders can enjoy customs tariff relief.

Transportation

According to the Ministry of Transport and Telecommunication,

- the scheduled flights in all routes of domestic flights are increased in frequency during this month.

- there are also arrangements to increase frequency of scheduled flights to all international airports.

COVID

- According to the order issued by Ministry of Health on 8th Oct 2022, there was relaxation of COVID restrictions at the international airports.

- In order to continuously control the infection of COVID-19, the rules and restrictions have been extended until the end of November 2022.

Market Potentials of Myanmar Rice Export

17 October, 2022

Rice is a vital crop in Myanmar and also in other Asian countries. Rice dominates the agricultural sector of the Myanmar economy and is comprehensively tangled into the social and economic lives of Myanmar’s people. Since Myanmar is a rice surplus country, it has the distinct potential to increase rice production, rice quality and exports over the medium and long run. Changes in rice economy might have a direct and profound influence on the entire economy. It is making important contributions to the country’s GDP, income and employment generations.

There are good market prospects to accommodate higher rice exports from Myanmar over the next 10-15 years. China is becoming a large net importer of Myanmar rice, and the European Union has opened its markets for duty free imports from Myanmar. According to the released data, Myanmar bagged US$700 million from two million tonnes of rice exports to foreign countries in the past 2020-2021 financial year. In the first half (April-September) of the current financial year 2022-2023, Myanmar shipped 983,782 metric tons of rice and broken rice to foreign trade partners with an estimated income of US$339 million, according to Myanmar Rice Federation (MRF).

Myanmar Rice Federation and relevant organizations and departments strike for seeking the market in Africa and Southeast Asia for rice exportation. In the past six months, more than 40 exporter companies delivered over 773,446 MT of rice and broken rice to external markets by sea, whereas over 210,335 MT were sent to neighbouring countries via border trade camps. Myanmar shipped rice and broken rice to regional countries, countries in Africa and European Union member countries through maritime trade. It is also exported to neighbouring countries, China and Thailand through cross-border posts. Myanmar exported rice to over 20 foreign markets in the past months, mostly to China 123,520 MT and the Philippines 101,259 MT.

In 2022, MRF and the Directorate General of Food of Bangladesh’s Ministry of Food signed the MoU to buy 250,000 tonnes of long-grain white rice with five per cent broken from Myanmar as the third time. Bangladesh bought 250,000 tonnes of white rice in 2017 and 50,000 tonnes of parboiled rice from Myanmar in 2021.

On the other hand, there is a strong competition from other exporters in the region – Thailand, Vietnam and Cambodia – and constantly rising demand for the higher-quality rice has put pressure on Myanmar’s rice sector. Moreover, there are also some limitations of Myanmar rice like the low productivity, poor rice quality at the farm level and the milling sector which operates with obsolete processing units causes about 15-20 percent losses in quality and quantity during the milling.

The rice industry can be implemented not only for export promotion but for import-substitute measures. Some 80 per cent of the annual production of rice is consumed by the people and making snacks and 20 per cent of rice is exported. Hence, the government and farmers need to cooperate in local consumption and the stability of the rice market. In order to continue rising the rice export, Myanmar must concern about the use of paddy dryers for maintaining the quality of rice in the post-harvest sector, the increase of rice mills capable of milling high-grade rice, the promotion of rice export, and effective application of digital technology in the rice and paddy to adapt the work procedures.

Last but not least, another limitation of Myanmar in expanding the export of rice might be the main export gate of Yangon Port which is small, outdated and with a limited capacity during monsoon seasons. So, the export processing costs are some of the highest in the region. All export procedures and port charges should be revised with a view toward improving the competitiveness of Myanmar rice. So that the market potential of Myanmar rice export could be promising in the long run.

Monthly Business Brief, September 2022

3 October, 2022

Banking and Finance

During September 2022, kyat depreciates against the hard currency US dollar at approximately K3,000 on the over-the-counter market although the Central Bank of Myanmar (CBM) set the reference exchange rate at K2,100, according to local forex traders. On 21st September 2022, the U.S. Federal Reserve increased its policy interest rate from 2.5 percent to 3.25 percent and the possibility of further interest rate has increased the value of the US dollar. Comparing the USD Index on (31.3.2022) and (29.9.2022), it is estimated that the Myanmar kyat is depreciate by 28% due to the increase of 14% in the US dollar.

Consequently, the price of pure gold continues to plunge to K2.7 million per tical (0.578 ounces or 0.016 kilogramme), according to the domestic gold market. The downward trend of pure gold in the domestic market is due to the fall in gold prices in international markets and the slide in the Kyat-dollar exchange rate. At present, gold price is US$1,630 per ounce and a dollar is exchanged at around K3,000 in the black market.

Trade

19th China-ASEAN EXPO, Business & Investment Summit held in Nanning, China

The 19th China-ASEAN EXPO (CAEXPO) and China-ASEAN Business and Investment Summit (CA¬BIS) took place in Nanning, Guangxi Zhuang Autonomous Region in China, were held from 16 to 19 September. Myanmar participated in its showroom and Myanmar representative galleries in the Regional Comprehensive Economic Partnership countries’ gallery area. In order to increase the export of Myanmar products, a total of 30 galleries including gemstones, wooden furniture, agricultural products and food products were displayed in the exhibition hall.

Exports market opportunity in European countries

According to the Ministry of Commerce, the value of trade between Myanmar and Germany from October to July of the current financial year 2020-2021 exceeded US$460 million. Myanmar’s export to Germany surpassed its import, with $349.882 million worth of export and $110.79 million valued import. Germany is the biggest trade partner of Myanmar in European Union, followed by Spain.

The main export items are rice, pulses, tea leaf, coffee, garments on a Cut-Make-Pack basis and fisheries. Meanwhile, machinery, data-processing equipment, electrical and optical goods, chemical products, motor vehicles and parts and pharmaceutical products, cosmetics, food and beverages and consumer goods are imported into Myanmar.

Manufacturing

According to the latest PMI data from S&P Global, Myanmar’s manufacturing industry contracted for the fifth month running during September. Both input and output price inflation rates hit record highs during September. The manufacturing performance in September is 43.1, falling from 46.5 in August. Firms linked the fall output to fewer new orders. At the same time, inflows of new business received at manufacturing firms across Myanmar also fell at the quickest rate in 13 months during September. In line with the fall in business requirements, firms continued to cut back on purchasing activity. Moreover, the pace of reduction in raw materials and semi-finished goods quickened on the month, as the respective index hit a 13-month low.

The overall dismal performance of Myanmar’s manufacturing sector, meant that the outlook for the coming 12 months remained largely subdued with only 2% of the respondents expecting growth.

COVID

In order to continuously control the infection of COVID-19, the rules and restrictions have been extended until the end of October 2022.

Rising Commodity prices and purchasing power

19 September, 2022

Consumer price index and rate of inflation

Consumer Price Index (CPI) measures the average change in the retail prices of goods and services purchased and consumed by households. In Myanmar, the Central Statistical Organization produces the CPI and the rate of inflation monthly, with data collection from 82 townships across all states and regions. The weights used in the production of the CPI are based on the levels of household income and expenditure as observed in the 2012 Household Income and Expenditure Survey.

In April 2022, the CPI increased 3.30 points compared to March 2022, leading to an annual rate of inflation of 10.72% and year on year inflation of 17.78%. Relative to the 2012 base period, the index number for the food group was 206.82, the non-food group was 180.79 and overall CPI was 196.01. Since the data mentioned here are from 4 months ago, so it doesn’t not reflect the current situation.

Rising commodity prices in August and September

In the current situation, people in the country are becoming more deprived as basic commodity and food prices have risen due to the rising dollar prices. The current exchange rate set by the CBM is MMK 2,100 while the market exchange is around MMK 3,300 per USD. The steep depreciation of the Myanmar Kyat and the rapid rise in inflation has led to sky-rocketing prices for essential items like food, fuel and medicines.

Currently the price of rice has increased by 45 per cent, while the price of palm oil has nearly tripled since last year. At the same time, prices for basic foods such as onions and potatoes has more than doubled, according to local markets. Prices of locally-grown vegetables like watergrass, cabbage and corn have doubled since last year due to higher transportation charges. The prices of peanut oil, sesame oil and sunflower oil are surging. The palm oil prices stayed between K8,500-K9,700 per viss.

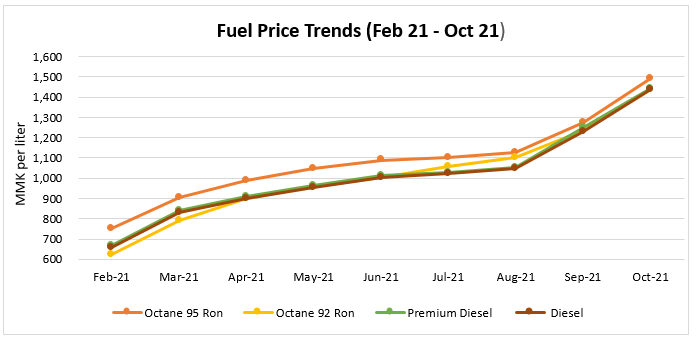

In addition, the price of imported fuel has almost doubled since last year, which has affected the transportation sector and commodity prices. Fuel prices went over 2,500 kyats per liter of diesel in September 2022, while it was just around 1,100 MMK per liter of diesel in September 2021. As a consequence, the bus fares of YBS buses went higher than before and for some buses, they even asked for MMK 500 and more. Moreover, the ferry service for the 200-mile-long Yangon-Mawgyun trip hiked the price up to K6,000 per passenger. Furthermore, the freight charge for the Yangon-Pyapon ferry trip increased from K200 to K300 per rice bag.

Rises in the cost of medicines in Myanmar are leaving many without access to treatment, too. The prices of basic drugs are doubling and clinics often short of supplies. Even medicines commonly used for treating head colds or flu now cost twice as much as they did before the Feb. A packet of the widely used household medicine Mixagrip used to cost around MMK 600 but now sells for around MMK 1,800. According to the owner of a drug store in Yangon, it is difficult to keep pharmaceuticals in stock because the costs charged by suppliers keep changing every day.

Consumer purchasing power and pricing strategy

With the higher of commodity prices and everyday costs, the purchasing power of the consumer is significantly low. Last year, MMK 5,000 can be enough for a daily meal including rice and edible oil, but now at least MMK 10,000 is needed to buy the same thing. So, people started to stop buying non-essential things like snacks and drinks. People just focus on filling in the stock of staple food.

Nevertheless, when there is some news about exchange rate or other stuffs such as the lockdowns of COVID, people are ready to use all their money to stock up their homes. At that time, the prices of the goods go higher and higher with the increasing demand. It’s quite easy for people especially the businessmen to increase a price with the increasing demand but drop down the price is a different story.

At present, lack of confidence on Myanmar kyat continues to deteriorate in the country and affecting access to markets, transport costs, and ability of shops to re-stock. Consumers and businesses are doing their best to confront the uninvited difficulties by using all the effort they’ve left. Only solution is to gain confidence on Myanmar kyat. Who will start and how to solve are still as big question marks in Myanmar economy.

Monthly Business Brief, August 2022

1 September, 2022

Banking and Finance

CBM orders in August

- On 5 August 2022, the Central Bank of Myanmar (CBM) announced that exporters have to convert only 65 per cent of the foreign incomes obtained from exportation into Myanmar kyats.

- On 16 August 2022, the CBM issued a statement that exporters can use 35 per cent of export earnings freely or make remittances to others.

- On 30 August 2022, the CBM announced that wages or salaries earned in foreign exchange by Myanmar citizens abroad remitted to the country via the licensed banks (authorized dealers of foreign exchange) shall be spent on their own, transferred to others and sold to banks independently starting from 1st September 2022.

New CBM governor and deputy governor

- On 19 August 2022, Daw Than Than Swe was appointed as CBM Governor and U Zaw Myint Naing was appointed as Vice-Governor of CBM.

Latest dollar and baht exchange rates

- The dollar exchange rate in the market on 31 August, 2022 is around 3,700 MMK per dollar and the Thai baht has becomes MMK 110 MMK per baht while CBM reference is 2,100 MMK per dollar and 57.75 MMK per baht.

Trade

- On 1 August 2022, the Ministry of Commerce released a notification that Importers are excluded from access to buy hard foreign currency at the regulated reference rate of the Central Bank of Myanmar.

- On 1 August, the Department of Trade issued a directive that licences will only be issued with the approval of Myanmar Pulses and Beans, Maize and Sesame Industry Association in order to obtain an export license for the export of sesame, oil crops, and pulses.

- On 27 August, it was eased to apply for a licence without seeking the approval. The relaxation will start from 29 August and export licence applicants do not need to seek a letter of endorsement from the association.

- On 19 August 2022, Union Minister for Investment and Foreign Economic Relations U Aung Naing Oo was appointed as the Union Minister for Commerce.

Investment

- According to the DICA’s statistics, Myanmar Investment Commission gave green light to 29 foreign projects, with an estimated capital of $1.22 billion during the April-July period. Those enterprises are to execute in manufacturing, power, real estate and service sectors respectively.

- Eight Singapore-listed enterprises brought in large investments of US$1.086 billion into Myanmar in the past four months (April-July) of the current financial year 2022-2023. Hong Kong SAR stood as the second-largest investor this FY with an estimated capital of over $64 million pumped by five projects. China is ranked third in the investment line-up with more than $55.7 million. One enterprise each from Belize and Japan also made investments in the past four months respectively.

Real Estate market

Currently, demand for high-end condos are strong and property prices are up along with the currency depreciation. The value of MMK is declining rapidly every minute and people are getting worried about getting poorer and poorer even though they are doing anything. So, people started buying real estate believing that it could keep them a certain value in the future. With the growing demand, the price of real estate in Yangon is getting higher and higher every day. But most of the buyers are Myanmar people as foreign investors are not thinking about investing in Myanmar’s real estate at the moment.

COVID

- In order to continuously control the infection of COVID-19, the rules and restrictions have been extended until the end of September 2022.

Growing demand on computers and accessories

15 August, 2022

Since 2021, Myanmar’s computer and laptop market attained the peak level and is still like to continue growing in the next few years. Before COVID period, people were not concerned much about having an own laptop or computer since it wasn’t an essential need for daily activity. However, during COVID period, the work from home habit started to adapt and everyone needed his own laptop or computer to carry on working through online. Besides, both teachers and students require those laptops or computers to have online classes.

Moreover, different kinds of online trainings, conferences and seminars are still holding which lead the demand of computers or laptops to increase more and more. At the current moment, even COVID isn’t too severe like in the previous months, people still don’t dare to hold meeting, or seminar or conference with a lot of people stuck in a single room. The government is also holding online training, meeting and conferences, so every government officer needs a laptop or computer. Besides, some companies find it effective in using online platform such as Microsoft tenant which is the set of services that they can assign to their organization.

According to the Trade Reports of Ministry of Commerce, import of computers and accessories were increasing overtime with 30-40% growth. Computers and accessories are being imported via overseas trade. Value of hand carry by air was not counted in the trade values. Past three year trends are seen as below:

- 2017-18 FY: US$ 80 mil

- 2018-19 FY: US$ 127 mil

- 2019-20 FY: US$ 147 mil

Due to market demand, popular brands in Myanmar markets are Lenovo, Asus, Dell, Acer and Apple, etc. Laptops with US$ 500-1,000 takes more market share followed by the value of US$ 1,500 – 2,000. Almost everything is becoming more and more expensive along with the increasing dollar prices in Myanmar. During August 2022, the dollar exchange rate set by the Central Bank of Myanmar is MMK 2,100 while the market price is from MMK 2,700 to MMK 3,000. People have to spend at least double to buy those computers, or laptops, or even its accessories nowadays. But people still have to buy one since laptop or computer is one of their basic needs at the current moment. We can see computer showrooms and sale centers occupied with customers even though the price of the products is rocket high.

Currently, China constituted the largest suppliers of desktop/laptop computers to Myanmar. Chinese assembled devices are also popular among Myanmar’s buyers because of its affordable price and being functionable for general users. In the next year, it is known that 25% of the production will be shared to Vietnam where investment environment and labours are attractive.

People in Myanmar have to struggle everyday with the increasing cost of living despite the low income. The needs are changing everyday and people have to follow the trend and fulfill the needs in order to keep up with the market and continue working. In the past times, it’s not a problem not having a computer or a laptop at a household, or just having one computer or laptop, but now it becomes essential needs for income earners and children in the household; to work, to learn, to be in the particular filed, and etc. As the computer consumption is growing, government should encourage FDIs to invest computer assembling and parts manufacturing in Myanmar so that the country enjoys technology transfer and consumers can access more products with affordable prices.

Monthly Business Brief, July 2022

1 August, 2022

Banking and Finance

- In domestic banking, it is announced that old individual bank account can be withdrew up to MMK 1 mil in every two weeks without any token while token is still needed for the company bank account.

- On 13 July 2022, CBM instructed AD banks to suspend transactions relating to the repayment of the principal and interest for offshore loans by Myanmar residents. It is also further instructed that companies have to inform the need to revise their payment schedules as needed in coordination with overseas lenders.

- On the same day, the CBM revokes the exemption for the foreign-owned companies. So, these companies are also obliged to convert the companies’ foreign currency into MMK within one business day of receipt. However, the other exemptions meant for the companies operating in special economic zones and the companies making investments approved by MIC remain valid.

- As the result of these announcements, the foreign exchange rate in the market is over 1,500 MMK per dollar leading some exchange counters to temporarily suspend the selling and buying of US dollars.

- On 29 July 2022, the world dollar price index was around 105 points and the foreign exchange rate set by the CBM was 1,850 MMK per dollar while the price in the black market is reaching around 2,900 MMK per dollar depending on the demand.

Trade

- Myanmar’s external trade between 1 April and 22 July of the 2022-2023 Financial Year (FY) tremendously rose to US$10.45 billion, reflecting a sharp increase of $2.066 billion as against the year-ago period. The figures surged from $8.386 billion in the corresponding period last year. Myanmar’s export was worth over $5.203 billion whereas, the import was valued at $5.25 billion over the past two months.

- The border trade dropped owing to the red tape and China’s strict virus rules, with a decrease of $191.45 million as against the year-ago period. However, the maritime trade registered a significant rise of $2.257 billion in nearly four months.

- The country’s export sector relies more on the agricultural and manufacturing sectors. The external trade stood at $15.5 billion in the past mini-budget 2021-2022 (October-March) period while it was $29.58 billion in the 2020-2021FY.

- According to the announcement of the Department of Trade on 14 July 2022, all applications for import/export licenses/permits including the exporter/importer registration certificate and its related documents can only be applied for during office hours from 9:30 AM to 2:00 PM using the Tradenet 2.0 system starting from 18 July, 2022.

- On 27 July 2022, it is announced that allowed foreign companies and foreign joint venture companies to export of high-processed pulses, corn, sesame seeds has been canceled according to the Ministry of Commerce.

Investment

- According to the Directorate of Investments and Companies, in the three months from April to the end of June of the fiscal year 2022-2023, only nearly 22 million dollars of foreign investment with 10 CMP and light manufacturing projects entered Myanmar.

- Moreover, the Department of Hydropower Implementation of the Ministry of Electric Power have invited open tenders to develop six new hydropower projects with private investment.

- The ministry invited hydropower companies interested in the project to be implemented in Phone In Kha, Kasan Ye, Namhmeseng, Nam Kan, Nam Tabat (Kayah) and upper Hsedawgyi. The statement added that interested companies need to conduct feasibility reports. Tender forms will be on sale until 8 August and bids must be submitted by 18 November, 2022.

Manufacturing

- The reference rate of palm oil in the Yangon market for a week from 25 to 31 July is set at K3,665 per viss. However, the market price is higher than the reference rate. The palm oil price is estimated at over K8,000 per viss in Yangon Region. The domestic consumption of edible oil is estimated at one million tonnes per year. Local cooking oil production is just about 400,000 tonnes. To meet the oil sufficiency in the domestic market, about 700,000 tonnes of cooking oil are yearly imported from Malaysia and Indonesia. So, the government encourages to domestic production of cooking oil.

- Besides, the State-run No 4 Fertilizer Factory (Myaungtaga) and No 5 Fertilizer Factory (Kangyidaunt) that suspended operations for three months have now resumed as usual and will produce urea fertilizer for farmers, according to the Ministry of Energy. They will produce 300 tonnes of urea fertilizers per day, respectively.

- Furthermore, Suzuki stated on 20 July 2022, that car productions of the Suzuki (Myanmar) Motor Co Ltd and Suzuki Thilawa Motor Co Ltd will be temporarily suspended, however, there will be no change in terms of warranty and service. The suspension is reported because of delays in the import of car parts to be assembled and manufactured due to current circumstances, although the company is doing its best to address the needs of the customers.

COVID

- In order to continuously control the infection of COVID-19, the rules and restrictions have been extended until the end of August 2022.

- Anyone arriving to Myanmar will be required to present a negative COVID-19 test, no older than 48 hours, and will be tested again twice during quarantine if needed.

- The Unvaccinated arrivals arriving in Myanmar will be required to quarantine for up to 5 days in an approved location. Fully vaccinated who tested positive upon arrival may be asked to quarantine.

Benefits of Mekong-Lancang Cooperation

18 July, 2022

Brief of Mekong-Lancang Cooperation

The Lancang-Mekong area is one of the regions with the greatest development potential in Asia and beyond. Lancang and Mekong differ in name, but refer to the same river—an important river running across China and the Indo-China Peninsula. Originating from China’s Qinghai-Tibet Plateau, the river has its source in Yushu of Qinghai Province. Lancang River in China is flowing out of Yunnan Province, while Mekong River is running across Myanmar, Laos, Thailand, Cambodia, and Vietnam, measuring 4,880 kilometers in length, covering an area of 795,000 square kilometers, and feeding altogether 326 million people. The five Mekong River countries are home to 230 million people and boast a combined GDP over US$600 billion and an average annual growth rate of about 7%.

Lancang-Mekong Cooperation (LMC) aims at bolstering the economic and social development of the Sub-regional countries, enhancing the wellbeing of their people, narrowing the development gap among regional countries and supporting ASEAN Community building as well as promoting the implementation of the UN 2030 Agenda for Sustainable Development and advancing South-South cooperation. Since its launch in March 2016, the mechanism has achieved the fast progress. It has developed a Lancang-Mekong cooperation culture of equality, sincerity, mutual assistance, and affinity.

7th Mekong-Langcang Cooperation meeting in Bagan

On 4 July 2022, Myanmar hosted the 7th Mekong-Lancang Cooperation Foreign Ministers’ Meeting in Bagan, Myanmar. The meeting was co-chaired by U Wunna Maung Lwin, Union Minister for Foreign Affairs of the Republic of the Union of Myanmar and Mr Wang Yi, State Councilor and Foreign Minister of the Peoples’ Republic of China. With the Theme of the meeting “Solidarity for Peace and Prosperity”, Union Minister stated that collective efforts with solidarity under the Mekong-Lancang Cooperation framework would be the best means to address current and future challenges. The Minister stressed prioritizing the cooperation for the economic revitalization and support of the “Global Development Initiative” of China as it effectively responds urgent needs of the Mekong-Lancang region.

Moreover, the other areas of cooperation such as water resources, agriculture, production capacity, power generation and renewable energy are also brought to the table. In addition, the State Councilor and Foreign Minister of the Peoples’ Republic of China discussed the future direction under the Mekong-Lancang Cooperation which includes promoting strategic leadership for sustainable development, expanding agriculture cooperation, to promoting green development, to enhancing cooperation on digital innovation and strengthening people-to-people exchanges.

Benefits for Myanmar Businesses

With the aim of common development, there will have benefits via Myanmar-China bilateral projects, importation of fertilizer from China to Myanmar, exportation of Myanmar’s agricultural and marine products to China, the re-entry of Myanmar scholars to China, maintenance of peace and stability along the Myanmar-China border, smooth flow of border trade between Myanmar and China. The Agreement of China-Aided Upgrading of No.2 Industrial Training Center (Mandalay) Project between the Ministry of Industry of Myanmar and Ministry of Commerce of China will also be a great benefit, too.

China will be implementing a lot of action plans on different sectors like the plan on Lancang-Mekong Agricultural Cooperation, the plan on Lancang-Mekong Water Resources Benefitting the people, the cooperation plan on Lancang-Mekong Digital Economy, the Lancang-Mekong Space Cooperation Plan, the Lancang-Mekong Talent Plan, and the Lancang-Mekong Public Health Cooperation Plan. All the plans share benefits of cooperation with the Mekong countries and add development momentum especially for least developing country, Myanmar.

Business sector could enjoy benefits in some extent from the Mekong-Lancang Cooperation programme.

Monthly Business Brief, June 2022

4 July, 2022

Banking and Finance

On June 9, the KBZ bank announced that cash can be withdrawn at 47 KBZ ATMs in four cities; Yangon, Mandalay, Nay Pyi Taw and Taunggyi. At the moment, 15 ATMs in Yangon, 10 ATMs in Mandalay, 13 ATMs in Nay Pyi Taw and nine ATMs in Taunggyi are set to withdraw cash. In Yangon, the maximum amount that can be extracted from an ATM is K 300,000 per week. Besides, mobile banking cardless withdraw can also be proceeded at those designated ATMs.

The dollar exchange rates stand at over K2,100 during June while the Central Bank of Myanmar (CBM) set the reference exchange rate at K1,850. The market rates are increasing steadily from K 2,058/K2,068 on 1 June to K 2135/2150 on 30 June, raised by around 4% just within a month.

Trade

Myanmar Rice exports – Myanmar’s agricultural products such as rice and rice-related products are exported by bulk carriers yearly. This year, the products will be exported to Europe and African countries from seven jetties at the Sule Port Terminal. There were 143,400 tonnes of rice to Belgium, Spain and Togo. The country exports about 200,000 tonnes of rice per month and expects to ship two million metric tons in 2022-23, according to the Myanmar Rice Federation. The high-grade rice is mainly exported to the Europe market, China, some ASEAN countries and Bangladesh while low quality rice, broken rice and brans are exported to Europe and African countries.

Myawaddy border trade news

Starting from 1 July 2022, all exports through the Myawaddy border are allowed to be denominated in US dollars according to some exporters. After that, it will be possible to export again only if the received bank slip of the export revenue has been shown. Currently, registered maize will be allowed to apply for export license from July 1 at US $ 360 per tonne. Moreover, trucks with Export Declaration (ED) are allowed to enter the Myawaddy Trade Zone till June 26, but trucks without EDs are to be allowed to enter the zone at a fixed price of US $ 360 per tonne, start from 1 July.

Import license period