The licenced overseas recruitment agencies are allowed to send employees abroad under the Overseas Employment Law (1999), according to the Ministry of Labour, Immigration and Population. Regarding granting licence to the overseas recruitment agencies, most employees choose to depart mainly to Thailand, Malaysia, Korea, Japan, Singapore, the United Arab Emirates, Qatar, Macao and Jordan. So far, Myanmar has sent 1,320,914 employees to foreign countries from 1990 to May 2021.

The Ministry of Labour, Immigration and Population has been increasing business licence deposit fees for the overseas employment agencies from K5 million to K25 million starting from 4 February 2020. It raised deposit fees to reduce the number of overseas employment agencies, make them interested in their businesses, and work effectively. It would also ensure more prominent agencies are more responsible and accountable. According to the Ministry, among the overseas recruitment agencies, there are 295 overseas employment agencies in Myanmar that pay increased deposit fees of K 25 million.

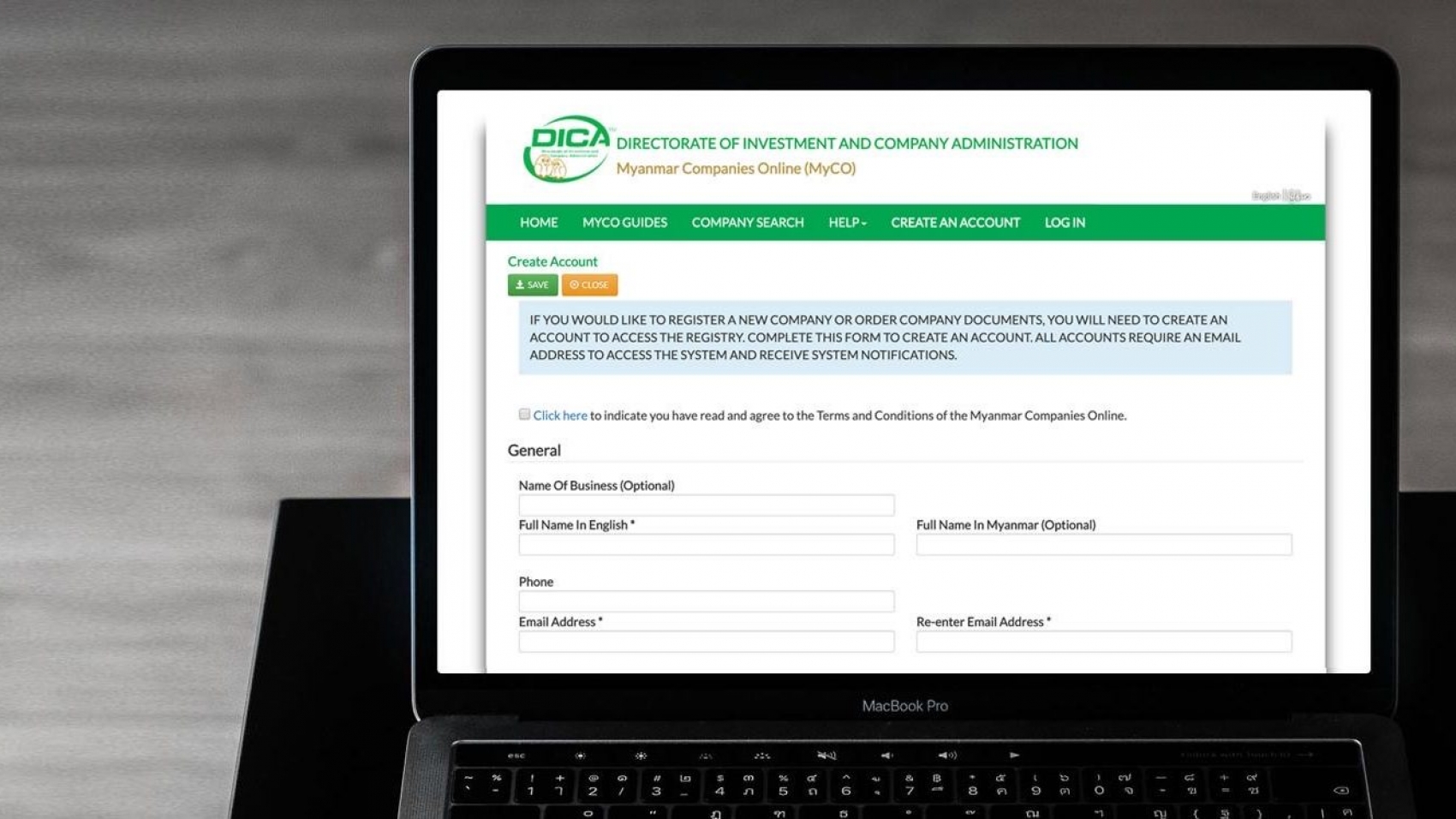

Those who wish to apply for the new overseas employment agency license need to come and apply for the permit at the department of labour relations (head office) in Nay Pyi Taw. The application must be signed in person by the managing director of the agency companies. The managing directors need to bring the necessary documents such as company profile, national ID, census and recommendation of the police station and ward. Those, who will apply for agency licences, must show proof of personal assets worth K100 million, an updated bank account with at least K100 million from the last six months and demand letters.

Source: The Global New Light of Myanmar