According to the statistics released by the Directorate of Investment and Company Administration (DICA), the number of companies registered on the online registry system MyCO reached over 2,600 in the first five months of this year.

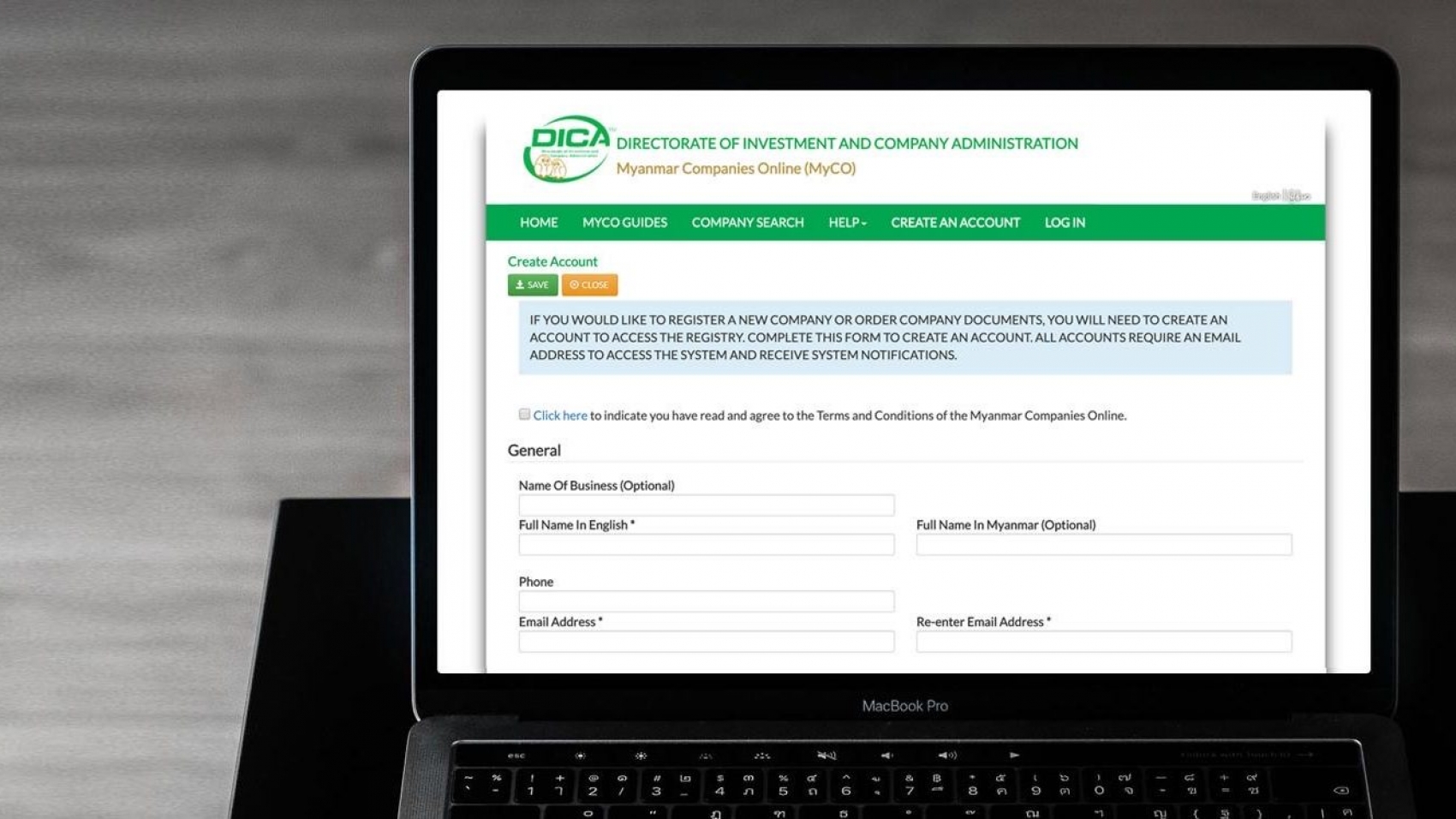

According to the Myanmar Companies Law 2017, registration must be done using the electronic registration system (MyCO), which was introduced on 1 August 2018. This year, the number of registered companies on MyCO was 1,373 in January, 188 in February, 163 in March, 254 in April and 686 in May, the DICA’s statistics showed. According to DICA, 100 per cent of MyCO system users are practising online application instead of manual filings. In 2020, the figures stood at 1,415 in January, 1,298 in February, 1,015 in March, 348 in April, 798 in May, 1,314 in June, 1,650 in July, 1,551 in August and 1,378 in September, 1,693 in October, 1,099 in November and 1,521 in December, the data of DICA showed. In 2019, the number of registered companies mounted to 1,733 in January, 1,419 in February and 1,108 in March, 1,045 in April, 1,411 in May, 1,307 in June, 1,428 in July, 1,302 in August, 1,181 in September, 2,059 in October, 1,615 in November and 1,772 in December as per statistics of the DICA.

When the online registry was launched in August 2018, 1,816 new companies got registered via MyCO. The figures stood at 2,218 in September 2018, 1,671 in October, 1,431 in November and 1,364 in December 2018. Further, all registered companies (old and new) need to submit annual returns (AR) on MyCo system within two months of incorporation and at least once a year (not later than one month after the anniversary of incorporation), according to Section 97 of Myanmar Companies Law 2017. According to Section 266 (A) of the Myanmar Companies Law 2017, public companies must submit the annual returns and the financial statements (G-5) at the same time. And, all overseas corporations must submit annual reports in the prescribed format on MyCo in 28 days after the end of the financial year under Section 53 (A-1) of the Myanmar Companies Law 2017.

The companies have to submit AR within AR due date. However, more than 16,000 companies were suspended as of September 2020 because they have filed to submit AR. Therefore, the newly established companies are requested to submit AR within two months of incorporation. If they fail to do so, they may face a fine of K 100,000. If the AR form is filed to submit within 13 months, the system will send a suspension (I-9A) notification letter in company status. Besides, if the AR form is also filed to submit after receiving (I-9A) within 28 days’ notice, the system will show suspended in company status. Under this situation, the companies can restore their status by paying AR and late fees. Then, the companies need to submit the I-9D form. The suspended companies will have to pay a fine of K50,000 for the AR fees, K100,000 for restoration of the company on the Register, and K100,000 for late filing of documents. If AR forms are filed to submit again within six months of suspension, the system will show struck off in company status.

Source: The Global New Light of Myanmar